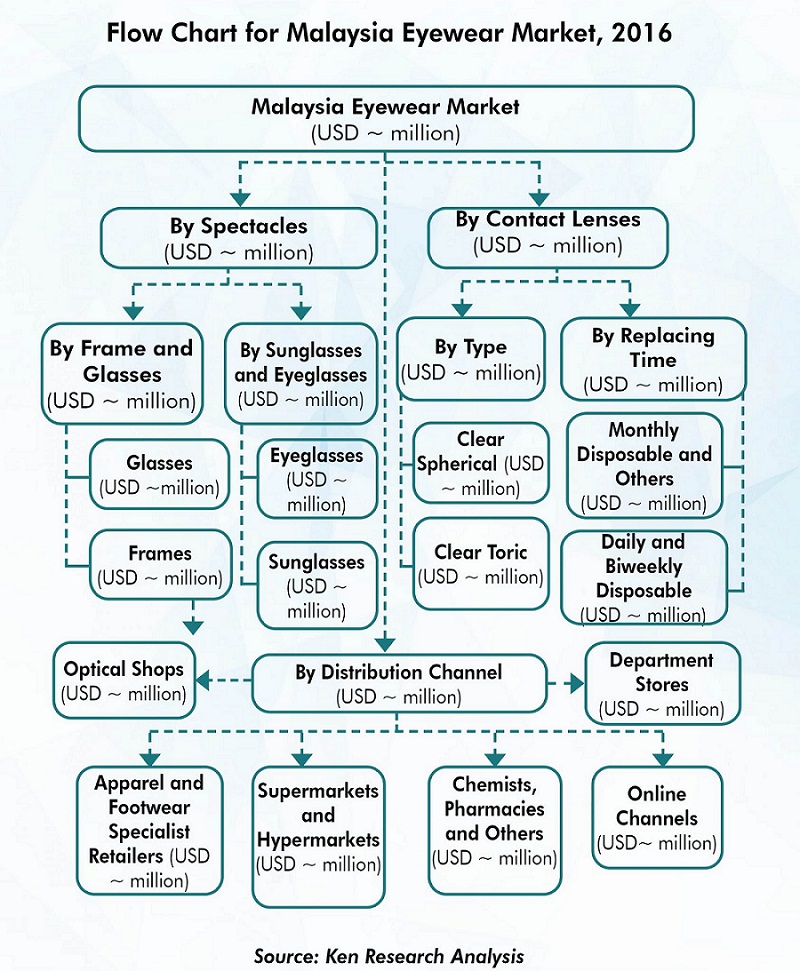

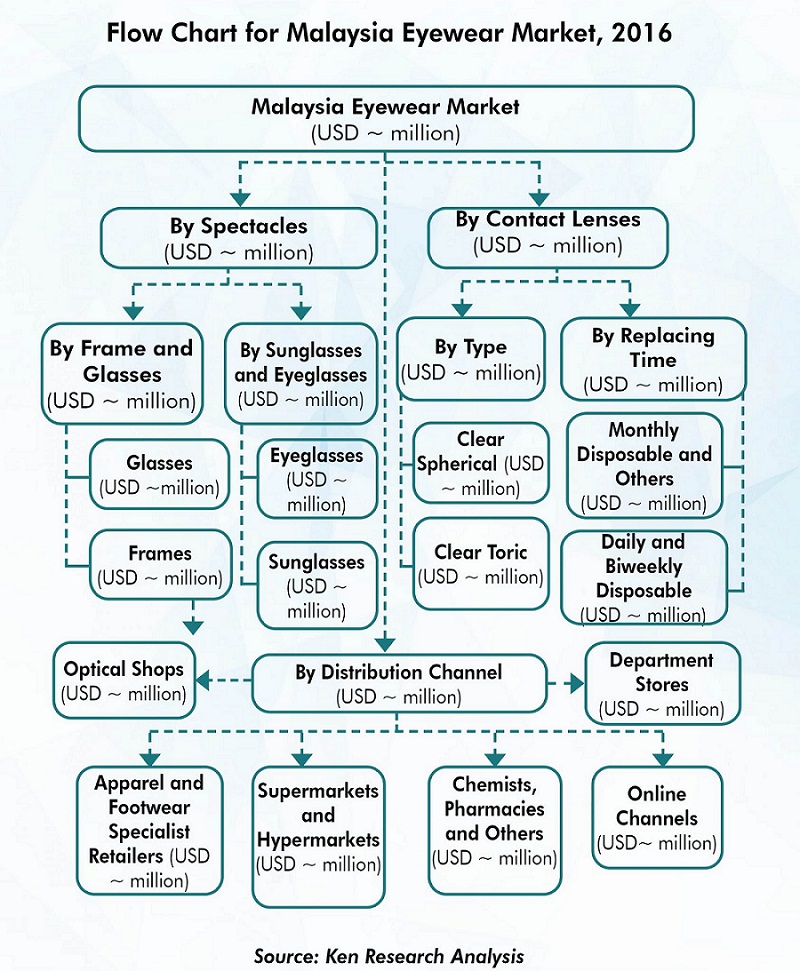

The report titled “Malaysia Eyewear Market by Type (Spectacles and Contact Lenses), By Sunglasses and Eyeglasses and By Sales Channel - Outlook to 2021” which provides an extensive analysis of Eye care products market in Malaysia. The report covers market size on the basis of revenue, market segmentation by spectacles and contact lenses, by type of spectacle glasses, spectacle frames and glasses, type of contact lenses, contact lens replacement time and by distribution channel. The report also includes the government initiatives and regulations in Malaysia eye wear market, competitive landscape and company profiles for major players in the eye wear market. The report provides detailed overview on the future outlook & projections with future strategies of the players in the market.

The report facilitates the readers with the identification and in-depth analysis of the existing and future trends and issues that impacts the industry and has anticipated growth in the future depending upon changing industry dynamics in coming years. The report is useful for eyewear manufacturers, importers, wholesalers, retailers, customers and other stakeholders to plan their market centric strategies in accordance with the ongoing and expected trends in the future.

Industry Overview

Malaysia is the third largest economy in Southeast Asia. The country was ranked 23rd most competitive country in the world for the period of 2017-2018. The monthly household income of Malaysians has increased at an annual rate of 6.6% from 2014 to 2016. Malaysia is one among the countries in the world where the vision impairments like myopia, hyperopia and presbyopia are rising at an alarming rate. Largely, owing to the increased demand for prescription glasses the eyewear market in Malaysia has grown at a CAGR of 6.4% during the review period 2011-2016. There is also a significant demand for sunglasses in the country. Malaysians are highly price conscious due to which the major players in the country offer branded eyewear products at discounted and affordable prices. Moreover, the optical shops in the country hold sales and promotional activities to attract a larger lot of Malay customers and also to accommodate the evolving consumer behavior, many optical shops have refurbished their existing store layouts to an open concept store layout.

Market Segmentation

In terms of revenue generation, spectacles dominated the eyewear market as of 2016 followed by contact lenses. While categorizing the market into spectacle glasses and spectacle frames in terms of revenue generation, spectacle glasses dominated the Malaysia eyewear market. Glasses has higher replacement rate in comparison to frames and since Malaysians are price conscious when lens replacement demand arises they would prefer replacing their glasses and not the frames, if they already possess one.

In 2016, eyeglasses held a higher share than the sunglasses. Such domination was supported by the rising rate of vision impairments in the country. It held a share of ~% in the overall market revenue. It was followed by sunglasses in 2016.

In terms of revenue, branded spectacles dominated the Malaysia eyewear market with a share of ~% in 2016 followed by unbranded products that accounted for a share of ~% in the market in the same year.

Optical shops are the most preferred distribution channel in the Malaysia eyewear market. They are widely spread over the various parts if the country in both rural and urban areas and are easily accessible. Optical shops have been consistently dominating the market from the past six years with more than 80.0% share in the market revenue. However, during the review period a gradual fall in the channel’s market share can be observed owing to the rising presence of other channels in the market.

Clear spherical lenses dominated the market in terms of revenue from contact lenses in 2016. The rate of hyperopia has seen a decline in the year 2016. However, the prevalence of hyperopia population in the country also contributes to the increased revenue from the sale of clear spherical contact lenses. Hyperopia among the children aged between 6-12 years is over 14.0%. Clear spherical lenses like other contact lenses are sold only based on a valid prescription at eye care clinics or optical shops in the country.

Toric lenses are used to correct astigmatism and it accounted for a share of ~% in 2016. Monthly disposable lenses contributed a higher share in the revenue derived from the sale of contact lenses in Malaysia. It accounted for a share of ~% in 2016. Daily and bi-weekly disposable contact lenses held a share of ~% in the contact lens market of the country as of 2016.

Competitive Landscape

Malaysia Eyewear market has been dominated by the increased demand for prescription glasses among the people owing to the rising rate of myopia, hyperopia and presbyopia. Hence, the top players in the market includes increasingly known for prescription glasses and contact lenses such as Essilor, Carl Zeiss, Hoya Corp., Johnson & Johnson and others. The major players in the market include manufacturers and retailers. In 2016, more than ~% share in terms of revenue in the market is held by eyewear manufacturers and retailers originated from countries like Italy, France, US, Germany, Switzerland and other countries.

Major manufacturers present in the market are Luxottica, Johnson and Johnson, Hoya Corp and others who compete on the basis of the number of in-house and licensed brands, price range, product variants of each brand, type of glasses and other parameters. Retailers include optical shops like Focus Point and many more that compete against each other on the basis of brands available in the shop, type of glasses offered, retail price, product variety, design of frames, type of glasses available in the store, sales and promotional activities and similar related features.

Future Potential of Malaysia Eyewear Market

Eyewear market of Malaysia is anticipated to showcase a decent growth at a CAGR of ~% during the forecast period 2016-2021. Certain factors that shall drive market growth during the forecast period are increasing rate of myopia, rising number of aging population, increased acceptance of contact lenses, changing fashion trends in the country and others. The most preferred choice of spectacles among the Malaysians is expected to be influenced from Korean fashion trends during the forecast period. In addition, an introduction of more entry-level branded sunglasses at relatively affordable prices is expected to be witnessed in the market. The availability of affordably priced sunglasses is expected to assist in stimulating the growth of sunglasses.

Key Topics Covered in the Report:

Malaysia Eyewear Market Overview and Genesis

Value Chain Analysis of the Malaysia Eyewear Market

Malaysia Eyewear Market Size

Malaysia Eyewear Market Segmentation

Government Initiatives and Regulations on the Malaysia Eyewear Market

Trends and Developments in the Malaysia Eyewear Market

Trade Scenario in the Malaysia Eyewear Market

Consumer Profile in Malaysia Eyewear Market

SWOT Analysis for Malaysia Eyewear Market

Competitive Landscape of Major Players in the Malaysia Eyewear Market

Future Outlook and Projections of the Malaysia Eyewear Market

Macroeconomic Factors affecting the Malaysia Eyewear Market

Future Outlook Eyewear Malaysia

Contact Lens Industry Size Malaysia

Malaysia Eyewear Market Segmentation

SWOT Analysis for Malaysia Eyewear Market

Malaysia Myopic Populations

Market Share Luxottica Malaysia

Sunglasses Market Malaysia Sales Volume

Eyewear Export Volume Malaysia

Malaysia Eyewear Marker Mergers and Acquisitions

Contact Lenses Market Revenue Malaysia

Value Chain Analysis Malaysia Eyewear Market

For more information on the research report, refer to below link:

Related Reports by Ken Research

Contact:

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-124-4230204

No comments:

Post a Comment